GET CAR INSURANCE

Affordable, reliable car insurance — made simple

Protect Your Car With the Right Insurance —

Quickly, Simply, and Affordably

Choosing the right car insurance shouldn’t feel confusing or overwhelming. Whether you’re buying a new vehicle, refinancing your current one, or purchasing privately, having the right cover in place protects you from unexpected costs, financial loss, and stressful surprises.

At MY OWN FINANCE, we work with trusted South African insurance partners to help you find affordable, reliable cover that matches both your budget and your driving profile.

And now, you can get a quick idea of what you might pay each month by using our Insurance Estimate Calculator below.

It’s fast.

It’s simple.

And it gives you a helpful starting point before requesting a personalised quote.

Why Car Insurance Matters

Whether you drive daily or occasionally, comprehensive cover protects you from:

Accident damage

Theft or hijacking

Fire or natural disasters

Damage to other vehicles or property

Medical emergencies

Unexpected repair costs

Write-offs and total loss scenarios

With the right plan, you can drive confidently —

knowing your finances and vehicle are protected.

WHY CHOOSE INSURANCE THROUGH MY OWN FINANCE?

End-to-End Finance Support - We Handle Everything For You

We Compare Multiple Insurers for You

No need to spend hours online filling out forms.

We gather quotes from several trusted insurance providers in South Africa.

You receive the best options — already compared and simplified.

Affordable Monthly Premiums

We negotiate competitive pricing and help you choose a policy that fits your budget without compromising on cover.

Better Cover for Your Car’s Current Value

If you’ve refinanced or purchased privately, your vehicle’s value might differ from what insurers assume.

We help ensure your policy actually matches your car’s real worth.

Friendly, Human Support

Insurance can be overwhelming. We explain everything in simple, easy-to-understand terms.

Fast, Easy Set-Up with Trusted, Reputable Partners

Once you choose your policy, we help activate your cover immediately — no delays. We work with South Africa’s leading insurance companies so you get reliable, credible cover backed by experience.

From application to approval, we handle everything —

negotiations, paperwork, comparisons and finance structuring.

You get a hassle-free, transparent process from start to finish.

HOW OUR INSURANCE PROCESS WORKS

Step 1: Calculate Your Car Insurance Premium

Tell us a few details about your vehicle and use our calculator to estimate your car insurance premium.

Step 2: We Compare Multiple Insurers

When you are ready to move forward, submit the form to request formal quote. We will then gather and compare offers from leading insurance companies in South Africa.

You receive clear, side-by-side options.

Step 3: Choose Your Perfect Policy

We explain each option — cover, excess, add-ons, and price.

You choose what makes sense for your needs and budget.

Step 4: Activate Your Cover Immediately

We help you get insured fast so you can drive with confidence and legal compliance.

The Benefits of Insurance Through Us

Save time by comparing multiple insurers at once

Pay competitive monthly premiums

Choose cover that fits your financial goals

Get expert guidance from friendly advisors

Avoid hidden terms and complicated fine print

Ensure your insured value is accurate

Quick, hassle-free cover activation

Insurance shouldn’t be stressful — and with us, it isn’t.

Get an Instant Estimate — Before You Commit

Every driver is different. Insurers look at your:

Vehicle value

Age

Driving history

Claims record

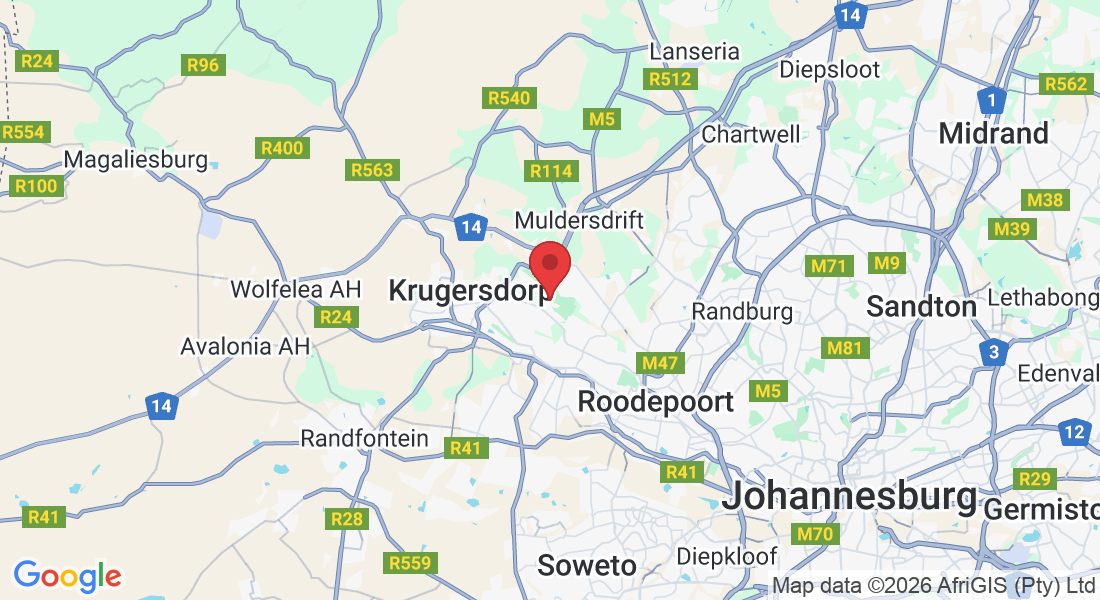

Where you live

How you use your car

Security measures you have in place

Our calculator considers these factors to show you an estimated monthly premium range, helping you understand what to expect before applying.

Important: This is only an estimate, not a formal quote.

For an accurate premium, personalised to your full profile, request a full insurance quote through us — it’s free, fast, and comes with friendly support.

Try our Insurance Estimate Calculator

Enter your details below to get an approximate monthly premium based on general risk factors.

Estimate Your Monthly Car Insurance

Get a quick idea of what your monthly car insurance premium could be based on your vehicle value and risk profile. This is an estimate only and not a formal quote.

Insurance Disclaimer: This tool provides an approximate premium range based on general risk factors and example rates. It is not a quote, not a guarantee of cover, and does not constitute financial advice. Actual insurance premiums will depend on your full profile, insurer underwriting, and final policy terms.

STILL NOT SURE?

Frequently Asked Questions

Question 1: Do I need car insurance if my car is financed?

Yes. Comprehensive insurance is required by all major banks for financed vehicles.

Question 2: Can insurance be activated before I receive the car?

Yes. We help ensure your policy starts the day you take ownership.

Question 3: How do you choose which insurers to compare?

We work only with reputable, established insurance companies in South Africa.

Question 4: Will my premium change if I refinance my car?

Possibly. Sometimes refinancing at a lower value can reduce insurance costs. We help you review your options.

Question 5: What documents are needed for cover?

Typically:

ID

Vehicle details

Proof of address

Banking details

Additional documents may be needed depending on the insurer.

Question 6: Can I insure a privately purchased car?

Yes, absolutely — and we help ensure the car is properly valued and protected.

Question 7: How long does it take to get insured?

Most policies can be activated within minutes once you've chosen your option.

Question 8: Can I lower my car insurance premium?

Yes. By adjusting excess, selecting certain add-ons, or updating your profile, you may reduce your premium. We help you find the best combination.

Follow Us

Follow Us

Your Independent Vehicle Finance Specialist

Our Services

Get Help

© MY OWN FINANCE — All Rights Reserved | Smarter Finance. Better Deals. Real Support.

Privacy Policy | Terms of Service | Cookie Notice - Powered by CMA

Disclaimer: MY OWN FINANCE is an independent vehicle finance facilitator. We are not a bank or credit provider. All finance approvals, interest rates, instalments and terms are subject to the credit assessment policies of South African banks and authorised finance partners. Calculators and website tools provide estimates only and do not constitute financial advice or a final offer.

POPIA Notice: By using this website or submitting any form, you consent to the secure processing of your personal information as outlined in our Privacy Policy. Your data is encrypted, confidential, and will never be sold or misused.

Terms: All services are provided in accordance with our Terms of Service, including the use of third-party banks, credit bureaus and compliance partners.

Regulatory Compliance: Our processes follow FAIS, FICA, and South African consumer finance guidelines. Final loan terms and approvals remain at the discretion of authorised financial institutions.